August 1914: Surprise or Countdown? February 14, 2012

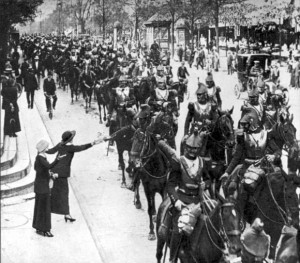

Author: Beach Combing | in : Contemporary , trackbackIn western memory, particularly in European memory the guns of August 1914 were a long awaited horror: and while the First World War was so much worse than anyone could have possibly imagined – Beach thinks of an earlier Churchill post on the nineteenth century comparing itself with the twentieth – everyone knew it was coming. Crudely, France’s and Germany’s bitter enmity had brought other allies in: but Russia, Austro-Hungary, Italy and Britain rather than keeping the two most important continental powers apart were dragged down into the abyss, with the main combatants screaming revanche and der Tag. (The picture above seemed too good to miss: heavy French cavalry on their way to wrestle with German machine guns). Any novel or screen film set in that halcyon summer, before the kingfishers were shot from the rivers, is always conscious of the coming end of European glory: see, for a musical example, this lovely Fairport Convention standard, the Summer Before the War – ‘the last of an age going by…’.

That at least is the official story, the story that the post-war generations were brought up with. But Beachcombing was sent this week a fascinating piece by British historian Niall Ferguson entitled (one of these titles where you shouldn’t feel obliged to read to the end) ‘Political risk and the international bond market between the 1848 revolution and the outbreak of the First World War’ published in a little known periodical (ahem!) the Economic History Review 59 (2006), 70-112.

Niall Ferguson is presently making a name for himself by putting forward the arguments for a pre-emptive bombing of Iran. Beachcombing is going to happily keep out of that debate. But back in 2006 and with research stretching back to 2001 Ferguson put a fascinating twist on the summer of 1914. He first demonstrated, convincingly, that the international bond markets were very sensitive to the threat of war and that they jumped hysterically every time a European war seemed likely or actually came to pass. A strange echo of present downgradings and Euro incompetence.

The fascinating thing though is that come 1914 the bond markets did not see it coming. They were still burbling along gently a fortnight after Archduke Ferdinand had been shot. It was not until 22 July, three weeks after Sarajevo and the day before the Austrian ultimatum, that The Times first mentioned the possibility of international financial problems and it was only a week later that the stock exchanges started to panic before promptly being shut down by presiding governments. War, of course, came immediately afterwards.

Ferguson uses this data to argue that the inevitability of the First World War has been exaggerated and that it was an avoidable political mistake. This forgets how many people in Europe wanted war, particularly in France and Germany. But his point that the world was not expecting war is well taken and seems an inescapable conclusion. ‘Like an earthquake on a densely populated fault line, its victims had long known that it was a possibility, and how dire its consequences would be; but its timing remained impossible to predict, and therefore beyond the realm of normal risk management.’

Perhaps there was an element of cry wolf, Europe had been fearing this moment since 1871 and it had never come? Perhaps too it was just too big an event, such a change that no one could really conceive or see coming? An ant sees another ant. It sees a bird. It sees a fox or dog. But does it really see the human bearing towards its nest, something many times bigger than all its world?

Beach found this 1 August editorial from The Economist especially haunting. A week before the good men of Bagehot had been worried about Ulster! Here, instead, you have the sense of the old world looking down and seeing that it has waded too deep into the stream and that the water is rushing over the top of its wellies. Sure, the points of reference are financial but you have only to read between the lines to hear the humming of shells.

‘The financial world has been staggering under a series of blows such as the delicate system of international credit has never before witnessed, or even imagined… Nothing so widespread and so world-wide has ever been known before.’

Three days later Lord Grey, British foreign minister and the man cursed to bring the news of war to his country would, watching the gas lamps being lit in London, put a more lyrical twist on this. ‘The lights are going out all over Europe [did he include Britain in this?], they will not come on again in our lifetimes.’

Any other examples of hindsight playing tricks on us: drbeachcombing AT yahoo DOT com

***